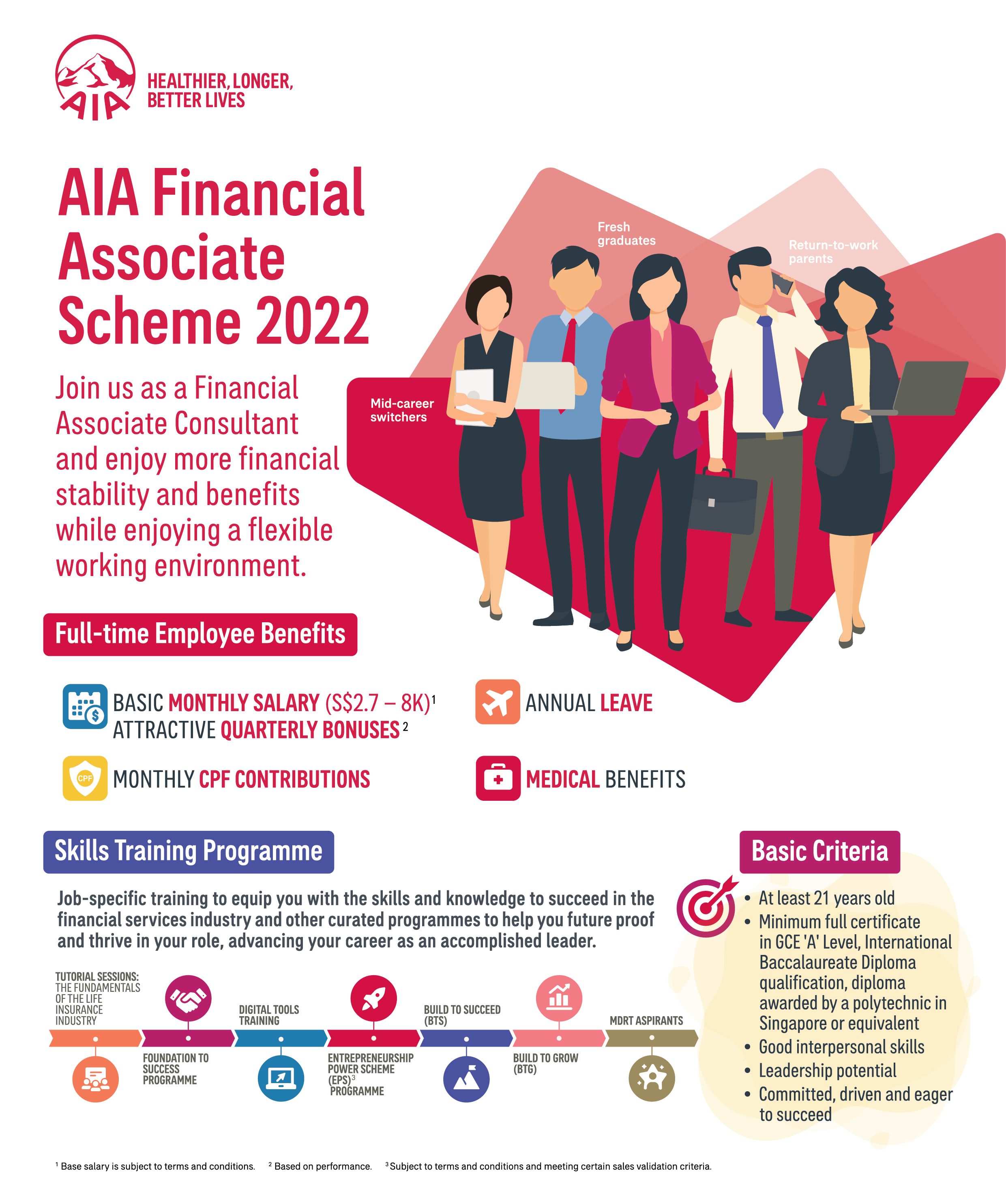

AIA Singapore introduces more than 500 financial sales advisory positions under new employment scheme providing greater financial stability to attract fresh graduates, mid-career switchers and stay-at-home-parents keen to return to the workforce

The scheme offers greater financial stability for individuals keen to pursue a career in financial services by providing full-time employment benefits including basic pay, CPF contributions combined with the flexible working environment enjoyed by AIA Financial Associate Consultants.

AIA's FAS will provide new AIA Financial Associate Consultants with a more stable and structured compensation model, including a base salary ranging from $2,700 – $8,000 per month[1] as well as attractive quarterly bonuses based on performance. Eligible candidates will be under the direct employment of AIA Singapore where they will get to enjoy full-time employee benefits, including CPF contributions, annual leave and medical benefits, while also be under the supervision of an agency leader.

To equip candidates with the relevant skills and knowledge to succeed in the financial services industry, candidates will undergo a holistic skills training programme where they will receive job-specific training and gain a fundamental understanding of the life insurance industry. As part of their career development, they will also be placed on training programmes focused in helping them succeed in this career and towards the managerial path.

Mr Chin Chung Wen, Chief Distribution Officer of AIA Singapore, said, "The AIA Financial Associate Scheme is in response to feedback from many talents we engaged with – from fresh graduates to mid-career switchers – who are keen to pursue opportunities in financial sales advisory but hesitate because of existing financial responsibilities they already have."

"Another key group we established this scheme for is stay-at-home-parents and women who want to return to the workforce. We want them to feel empowered and confident to re-start their professional lives with AIA, and we believe that the career provides them the stepping-stone to make this happen. Creating a more conducive environment for women to re-join the workforce will also help address the tight labour market we are currently experiencing."

"AIA Financial Associate Consultants are not simply financial consultants, they play a critical role in influencing lives and being a trusted partner for their clients throughout life's journey. As a leading insurer, AIA is dedicated to nurturing our insurance representatives into future leaders; inspiring them beyond their comfort zones and allowing their talents to truly shine in the process," Mr Chin added.

There are approximately 260,000 women in Singapore who are well-placed to return to the workforce[2]. The recent White Paper on Singapore Women's Development, a whole-of-society review of Singapore women's development, also outlined the imperative of pursuing initiatives that enable more women to participate more fully in the workplace[3].

The creation of more than 500 new positions under this new scheme is aimed at expanding AIA's distribution capability which is currently already one of the strongest in the country.

For 7 consecutive years, the AIA Group has achieved the largest number of MDRT members and is the only multinational company in the world to have done so. AIA Singapore has also achieved the highest number of Million Dollar Round Table (MDRT) registered members for seven consecutive years from 2014 to 2020. In 2021, AIA Singapore doubled our number of MDRT achievers. Internationally recognised as the gold standard of excellence in life insurance and financial services, AIA's agency force represents the industry pinnacle in professional knowledge, ethical conduct and outstanding client service. AIA Singapore is also ranked among the top 15 best workplaces in LinkedIn's Top Companies in Singapore 2022.

The company is recognised for equipping AIA Insurance Representatives with the latest digital tools, best-in-class business knowledge as well as high service and professional ethics standards, empowering them to help individuals, families and businesses protect what matters most to them.

AIA Singapore is consistently recognised for its digital innovations to support AIA Insurance Representatives and customers alike. iSmart, an analytics-backed super-app for the agency force to better engage with customers, and AIA Claims EZ, an AI-enabled platform which makes the digital claims experience faster and more seamless, were recently awarded with the Gold and Bronze awards respectively at the Asia e-Commerce Awards 2021 by Marketing Interactive[4].

Individuals who are interested to apply for the scheme can visit: www.aia.com.sg/financialassociatescheme

About AIA

The business that is now AIA was first established in Shanghai more than a century ago in 1919. It is a market leader in Asia (ex-Japan) based on life insurance premiums and holds leading positions across the majority of its markets. It had total assets of US$340 billion as of 31 December 2021.

AIA meets the long-term savings and protection needs of individuals by offering a range of products and services including life insurance, accident and health insurance and savings plans. The Group also provides employee benefits, credit life and pension services to corporate clients. Through an extensive network of agents, partners and employees across Asia, AIA serves the holders of more than 39 million individual policies and over 16 million participating members of group insurance schemes.

AIA Group Limited is listed on the Main Board of The Stock Exchange of Hong Kong Limited under the stock code "1299" with American Depositary Receipts (Level 1) traded on the over-the-counter market (ticker symbol: "AAGIY").

1. Hong Kong SAR refers to Hong Kong Special Administrative Region.

2. Macau SAR refers to Macau Special Administrative Region.

#AIASingapore