SDK to Record Operating/Non-operating Expenses for Acquisition of Hitachi Chemical's Shares, and Extraordinary Loss

- Written by ACN Newswire - Press Releases

|

|

|

|

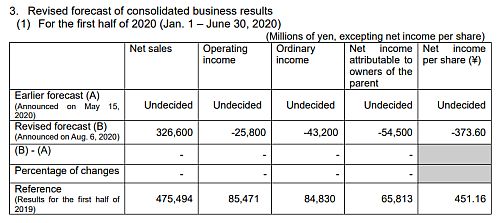

Furthermore, SDK has decided to revise its forecast of consolidated performance for the first half of 2020 as described below. (In our earlier news release of May 15, 2020, performance forecast was left "undecided."). In the graphite electrode business, where demand is sluggish, SDK has decided to record a 21.7 billion yen loss on valuation of inventory in accordance with the "lower of cost or market" accounting method. In addition, SDK has reviewed the influence of the coronavirus disease 2019 (COVID-19), and the sharp decline in crude oil prices, on SDK's financial results. Forecast of dividend payment is revised accordingly.

SDK is now examining its forecast of consolidated performance for full-year 2020, as business results after integration with Hitachi Chemical. Explanations will be provided at the time of announcement of the second quarter, 2020 business results on August 12, 2020.

1. Recording of expenses for acquisition of shares in Hitachi Chemical

SDK will record expenses of 21.6 billion yen, consisting of 4.3 billion yen operating expenses and 17.3 billion yen non-operating expenses, in the first half of 2020 with regard to its acquisition of shares in Hitachi Chemical. "Advisory fee, attorney's fee, post-merger integration (PMI) expenses, expenses related to fund-raising, and registration and license tax" are temporary expenses.

"Interest on borrowing related to share acquisition" represents expenses corresponding to the first half of 2020.

(1) Advisory fee, attorney's fee, etc. 3.5 billion yen (Operating expenses)(2) Post-merger integration (PMI) expenses 0.8 billion yen (Operating expenses)(3) Expenses related to fund-raising, registration tax, etc. 16.1 billion yen (Non-operating expenses)(4) Interest on borrowing related to share acquisition, etc. 1.2 billion yen (Non-operating expenses)----------Total 21.6 billion yen

2. Recording of extraordinary loss

(1) Provision for closure of Meitingen Plant, Germany, in the graphite electrode business

We are facing prolonged graphite-electrode-inventory adjustments by electric steelmakers. In the European market, in particular, where economic slowdown is serious, our operating rates are low. After discussions with the labor union, we reached agreement on the closure of a production site in Meitingen, Germany, belonging to SHOWA DENKO CARBON Products Germany GmbH & Co. KG and SHOWA DENKO CARBON Germany GmbH. Thus, to cover expenses relating to the closure, we will record 4.7 billion yen expenses for business structure improvement as extraordinary loss during the first half of 2020.

3. Revised forecast of consolidated business results

(1) For the first half of 2020 (Jan. 1 - June 30, 2020)*See http://acnnewswire.com/topimg/Low_SDK202008061.jpg

(2) Reasons for the revision

Sales in the Inorganics segment will decline sharply. This is because demand for graphite electrodes (used in electric steelmaking) has fallen considerably due to the spread of slowdown in steel production from Europe to the rest of the world, resulting in a sharp decline in sales volumes and market price. Sales in the Petrochemicals segment will also fall sharply due to the fall in product market price, reflecting the rapid decline in naphtha prices. The impact of COVID-19 includes lower shipment volumes of basic chemicals and industrial gases due to the shrink of domestic demand; lower shipment volumes of aluminum fabricated products due to the slowdown in the world's automobile production; and lower shipment volumes of aluminum cans, reflecting production cuts by beer producers in Vietnam in April and May. Thus, sales in the Chemicals and Aluminum segments will decline.

The Inorganics segment will record a large amount of operating loss. This is due to the fall in sales volumes and market prices in the graphite electrode business, as well as the recording of the 21.7 billion yen loss on valuation of inventory in accordance with the "lower of cost or market" accounting method. The Petrochemicals segment expects a fall in operating income due mainly to the negative influence of the difference between the receipts and disbursements of raw materials, reflecting the sharp decline in naphtha prices. The Chemicals and Aluminum segments expect a fall in operating income due to lower shipment volumes under COVID-19.

Ordinary income reflects non-operating expenses for the acquisition of shares in Hitachi Chemical as described in 1 above. Net income attributable to owners of the parent reflects the extraordinary loss as described in 2 above.

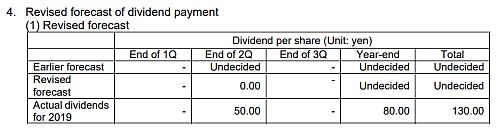

4. Revised forecast of dividend payment

(1) Revised forecast*See http://acnnewswire.com/topimg/Low_SDK202008062.jpg

(2) Reasons for the revision

Based on the forecast of the performance for the first half of 2020, we have revised our forecast of dividend payment. In view of the severe business environment, we will not pay dividends at the end of the second quarter.

Note: The forecast in this document has been worked out based on information available as of today, and assumptions as of today about uncertain factors that can affect our future performance. Actual business results may differ materially from the above forecast due to a variety of risk factors, including, but not limited to, the impact of COVID-19 on the world economy, economic conditions, costs of naphtha and other raw materials, demand and market prices for graphite electrodes and other products, and foreign exchange rates.

About Showa Denko K.K.

Showa Denko K.K. (SDK; TSE:4004, ADR:SHWDY) is a major manufacturer of chemical products serving from heavy industry to computers and electronics. The Petrochemicals Sector provides cracker products such as ethylene and propylene, the Chemicals Sector provides industrial, high-performance and high-purity gases and chemicals for semicon and other industries, the Inorganics Sector provides ceramic products, such as alumina, abrasives, refractory/graphite electrodes and fine carbon products. The Aluminum Sector provides aluminum materials and high-value-added fabricated aluminum, the Electronics Sector provides HD media, compound semiconductors such as ultra high bright LEDs, and rare earth magnetic alloys, and the Advanced Battery Materials Department (ABM) provides lithium-ion battery components. For more information, please visit www.sdk.co.jp/english/.

Contact:Showa Denko K.K., IR Office, Finance & Accounting Department, Tel: 81-3-5470-3323

Copyright 2020 JCN Newswire. All rights reserved. www.jcnnewswire.com

Authors: ACN Newswire - Press Releases

Read more //?#