Indonesia is the world’s largest seaweed producer but why are prices so volatile?

- Written by Zannie Langford, Research Fellow, The University of Queensland

Over a million coastal people[1] in Indonesia rely on income from seaweed farming, contributing to the country’s rapidly expanding seaweed industry.

Demand for the seaweed extract carrageenan[2], used as a gelling agent in many processed foods, has been driving the growth. Currently, Indonesia is the world’s largest[3] carrageenan seaweed producer.

However, prices in the industry are volatile, which makes it difficult for farmers to earn a sustainable income. This can reduce production quantities and could affect government plans[4] to expand production five-fold.

The factors that drive price changes have not been well understood due to limited data availability on seaweed prices in Indonesia. We undertook the first formal price analysis of the seaweed industry in Indonesia.

We identified three key factors driving price changes in Indonesia: China’s seaweed processing industry, seasonal growth patterns and the COVID-19 pandemic.

1. Long-term changes in the Chinese seaweed processing industry

China is the largest processor of Indonesian seaweed[5]. The price offered to Indonesian exporters is strongly influenced by derived demand from Chinese carrageenan seaweed processors.

Indonesia’s international trade relationships with China affect domestic prices.

One of the main reasons that Indonesia is so competitive in the international seaweed market is that the buying power of international currency is high in Indonesia. This means Indonesian farmers can produce more cheaply than farmers in other countries, for whom the low prices often do not cover the production costs.

Indonesia and China have a complementary relationship, as Indonesia produces the raw material but has limited processing capacity, while China lacks raw materials but has a large processing industry. Indonesia relies on Chinese carrageenan processors to purchase seaweed, and Chinese carrageenan processors also rely on Indonesian seaweed to feed their plants. This relationship has a strong influence on seaweed prices paid to Indonesian farmers.

However, this trade relationship is changing.

In 2017, the world’s largest seaweed processing company, BLG from China, opened a new processing factory in South Sulawesi[6].

Following this development, seaweed prices rose on average 157% from July 2017 to March 2018 – from an average price of 9,000 Rupiah/kg or around 63 US cents to an average price of 23,000 Rupiah/kg or US$1.6.

The demand for seaweed from BLG seems to have increased seaweed prices, and BLG has developed systems for seaweed procurement as they continue to operate under capacity.

2. Seasonal changes in ocean conditions in Indonesia

Another key factor that affects seaweed prices is seasonal changes in seaweed growth throughout the year.

Prices are lowest in the middle of the year and highest at the start of the year.

Although not much is known about seaweed seasonality around the country, this is thought to be because the major seaweed producing regions produce more in the middle of the year.

Following the law of supply and demand, the greater supply pushes prices down. This happens in all locations, even though some of these locations have different seasonal patterns.

It might be possible for farmers to increase their income if they can plan strategically around these seasonal changes, and further research into seaweed production seasonality could support this. It could also support improved distribution of seaweed propagules to seaweed farming areas.

3. COVID-19

Most recently, COVID-19 has had a significant effect on seaweed prices.

With export restrictions, less seaweed was exported, and as a result seaweed traders purchased less seaweed. Prices quickly dropped as many farmers competed to sell their seaweed.

We analysed how different locations were affected by this change, and we found that more remote areas in Maluku and Kalimantan were much more severely and quickly affected.

Prices in these locations dropped by over a third in the first months of the pandemic, whereas prices in more central areas such as Bali and South Sulawesi only dropped 10-20%.

We identified these three factors by analysing seaweed prices in Indonesia.

We used seaweed price data in Indonesia[7], collected every two weeks for the last fifteen years by Jasuda[8], a seaweed research organisation based in Makassar.

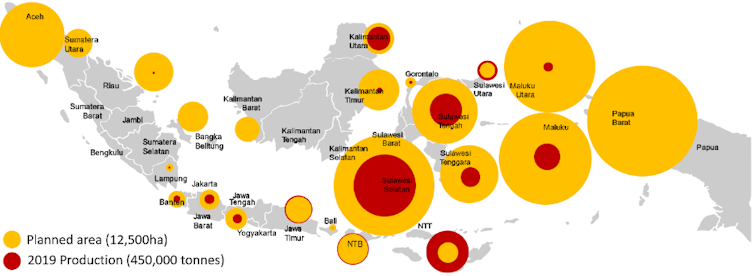

We extracted 5-10 years of data for 13 locations across Indonesia to explore how prices in these locations have changed.

Firstly, we wanted to understand how prices across the country were related. We used a Vector Error Correction Model[9] to test the extent that prices across the country are related to each other, known as “price co-integration”.

We found that Takalar, the largest seaweed producing region in South Sulawesi, which is the largest seaweed producing province in Indonesia, was the price leader – this means that when prices in Takalar change, prices across Indonesia will follow.

We also used a mathematical method known as additive time series decomposition[10] to break down this data into its long-term trend and seasonal components.

This means that we can see how the price data changes between years, and how it changes the same way each year.

What is clear from this analysis is that prices in Indonesia are driven by dynamics in the Chinese seaweed processing industry and seasonal production patterns in Indonesia.

Future research into these areas would provide insights into the mechanisms driving these changes and could be used to help farmers access higher and more stable prices.

References

- ^ Over a million coastal people (peraturan.bpk.go.id)

- ^ carrageenan (www.cabdirect.org)

- ^ world’s largest (www.fao.org)

- ^ plans (peraturan.bpk.go.id)

- ^ largest processor of Indonesian seaweed (www.fao.org)

- ^ opened a new processing factory in South Sulawesi (sulselprov.go.id)

- ^ seaweed price data in Indonesia (jasuda.net)

- ^ Jasuda (jasuda.net)

- ^ Vector Error Correction Model (doi.org)

- ^ additive time series decomposition (doi.org)

- ^ here (doi.org)

Authors: Zannie Langford, Research Fellow, The University of Queensland