Blue Orca's Short Selling Plan Failed Because the Quality China Medical System (867.HK) Can Withstand Severe Tests

- Written by ACN Newswire - Press Releases

|

|

|

|

|

|

|

|

|

|

According to Zhitongcaijing APP, recently, Blue Orca targeted China Medical System (867.HK), a well-known Chinese pharmaceutical company, by releasing a short selling report against the company on the morning of February 6, pointing out that this Chinese pharmaceutical company "is simply uninvestable".

Influenced by this report, the share price of China Medical System fell sharply by 12.7% from its peak at HK$ 10.72 to HK$ 9.36. However, due to the insufficient evidence of the allegations and the suspicion that Blue Orca had engaged in malicious short selling, a short selling report was not enough to shake investors' confidence in this high-quality company. The company's share price rebounded sharply after hitting the bottom of HK$ 9.35 at 11:03 a.m.. Moreover, before the suspension of trading, it rebounded by 9% to HK$ 10.2 in just 14 minutes at 11:17 a.m.

In recent years, it has been common for foreign short selling agencies to short sell Chinese companies, even for high-performing stocks such as BoSiDeng and ANTA Sports. In 2019, only Blue Orca itself has issued short selling reports against companies such as Kasen International, Ausnutria and NOVA Group.

However, by analyzing the market data on trading days before the release of Blue Orca's short selling report, Zhitongcaijing APP found that the short selling ratio of China Medical System had increased significantly, thus making this short selling incident worth pondering. Consequently, it's necessary for investors to rationally analyze this short selling report and correctly understand the intrinsic value of China Medical System.

Part 1 "Untenable" reasons for short sellingShort selling agencies commonly create notions of "guilt" at the beginning of their reports to guide investors decisions about a company regardless the authenticity of the evidence and data. Therefore, Blue Orca wrote "China Medical System is simply uninvestable" at the beginning of the report.

Next, the report listed four reasons why Blue Orca believed that the company had "fraud and corruption": 1. The company's filings in China indicated net profit was 49% less than the number reported in its annual report; 2. There were problems in Malaysia's tax benefit; 3. The company secretly funded the R&D expenses for chairman's private company; 4. Drug development pipeline: trading transactions between the company and the chairman.

For challenges raised by Blue Orca, investors are most concerned about the truth. Faced with the aggressiveness of Blue Orca, China Medical System promptly clarified and refuted the relevant charges. Investors can conclude from the company's announcement in response to the short selling report that the allegations made by Blue Orca were untenable. Zhitongcaijing APP also summarized the following information according to the company's reply.

Regarding the company's financial inflation: the business of Malaysia subsidiary actually exists.

Blue Orca doubted the existence of China Medical System's subsidiary in Malaysia and believed that China Medical System used its subsidiary's tax benefits to inflate its profits.

In fact, as an international pharmaceutical company, the business of China Medical System is divided into international business and domestic business. The international business section includes CMS Pharma (Malaysia) and Sky United Trading Limited, and the domestic business includes Shenzhen Kangzhe and Tianjin Kangzhe.

According to the clarification announcement of China Medical System, the company's international business functions are now mainly undertaken by its Malaysian subsidiary. These functions include: investment and introduction of new products, screening and evaluation of production plants, quality and supply chain management and control, the strategy formulation of macro promotion of products, and all risks related to the functions. The business and performance of the subsidiary really exist and enjoy local preferential tax policies. In addition, the company also stated that it has repeatedly discussed with professional tax consultants the issue of ensuring that the pricing of related transactions is reasonable and in line with the provisions of the domestic taxation bureau.

It's pretty simple to verify the authenticity of the company's performance, since the financial statements of China Medical System have continually been audited by one of the "Big Four" international accounting firms. Therefore, if there were inflated profits, Blue Orca would not have been the first to notice the problem.

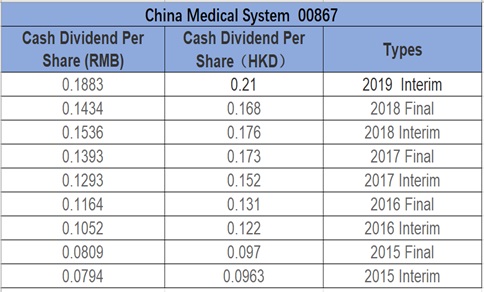

In addition, to verify the company's profit, Zhitongcaijing APP reviewed its dividend payout in recent years. In recent years, the company has maintained a dividend payout ratio of 40%, with a dividend of RMB 729 million in 2018, accounting for 41% of the company's current free cash flow. This mainly thanks to the company's stable profitability. In light of this, if there was a large range of actual profit fluctuation, the company could not distribute such high dividends. The Blue Orca's allegation against China Medical System can also be refuted from this side.

China Medical System secretly funded research expenses for its chairman's private company and that the chairman then "resold intellectual property rights" to the company? False.

Taking advantage of information asymmetry to win the trust of investors has always been a common practice for short selling agencies, and Blue Orca made the most of it in this allegation.

Blue Orca devoted the biggest portion of its report to "struggle" with the industrial and commercial information of Kangzhe R&D and used it as evidence against China Medical System. This is exactly how they took advantage of information asymmetry.

As can be seen from China Medical System's clarification announcement, Kangzhe R&D does incur operating expenses, and thus chose not to disclose relevant information to the public when submitting operating expenses data to China's State Administration for Industry and Commerce (SAIC) in accordance with relevant regulations.

In addition, Blue Orca also cited a series of cases about companies such as Helius and Faron, so as to allege the chairman of China Medical System of using the resources of China Medical System for his personal gain, rather than participating in drug development.

The core of Blue Orca's allegation is that "the chairman [was] seeking personal gain," but if there was no such personal gain, this charge is meaningless.

In fact, none of the projects mentioned by Blue Orca being "suspected of reselling" required the company to pay down payments, the relevant payments for registration, sales milestone fees, or R&D expenses. Even though the projects, such as the Faron and Helius, were not finally approved, China Medical System did not bear any risks and costs.

According to the short selling report, it is clear that Blue Orca did not understand the practice of Lam Gang, the Chairman of China Medical System. After all, it is not in line with the "principle of a rational person" to bear the risks for the benefit of shareholders. This misunderstanding, however, is because Blue Orca does not understand what a "a doctor's sense of mission" entails.

In fact, some people, including Chairman Lam Gang, from the management were former doctors. Therefore, contrary to the allegations of Blue Orca, it is precisely that Lam Gang understands doctors and patients with the feelings of medical practitioners and hopes to introduce highly innovative, professional and clinically demanding drugs into Chinese market for the benefit of Chinese patients and families. Therefore, in the early stage of innovative drug investment, Lam Gang always bore higher risks himself. Furthermore, among early projects invested by him, NRL-1 (Diazepam Nasal Spray) has been approved for launch in the United States, and Helius project is also ready for application to the FDA again for marketing authorization. Therefore, it cannot be concluded that investments made by Lam Gang have all ended in failure.

In addition, in the context of the deepening of China's medical system reform and the increasing support for the development of innovative drugs, the company's development strategy has expanded from products that have already launched to the market to unlaunched innovative products in China. Therefore, the active arrangement of innovative drugs is pivotal to the rational transformation and upgrading of pharmaceutical enterprises, which is in stark contrast to the "misleading development" mentioned in Blue Orca's report.

In conclusion, the allegation of Blue Orca against China Medical System was insufficient in both the viewpoint and the proof, so it could hardly function as a rigorous short selling report, thus not worthy of investors' reference.

However, the purpose of Blue Orca may not be simply issuing a short selling report that was not rigorous.

Part 2: A premeditated "short selling operation"It is worth our attention to consider that agencies issue short selling reports for their own profits rather than for those of the investors.

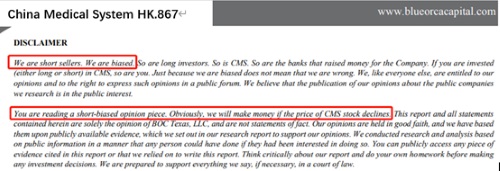

In the 41 pages extensive short selling report, Blue Orca had to mention in the disclaimer that "we will make money if the price of China Medical System stock declines." This is a common trick of short selling agencies: issuing short selling reports, triggering panic sales by investors, and then leaving after quickly making a large amount of money.

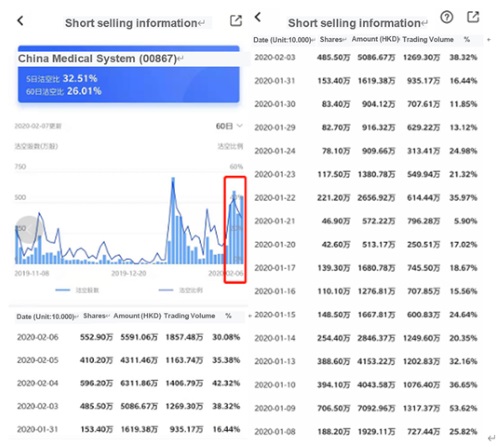

The data presented by the Zhitongcaijing APP clearly showed that from December last year to January 7 this year, the historical average short selling ratio of the company remained around 5%, with a minimum of only 0.17%, and the amount of short selling totaled only HK$ 22,200. This normal short selling reflects investors' bullish sentiment towards China Medical System.

However, on January 9, the company's short selling ratio suddenly rose to 53.62%, with an amount of HK$ 70,929,600. In the following month, the company's short selling ratio mostly fluctuated between 10-30%.

On February 3, before the report was released, the company's short selling ratio rose sharply to 38.32%, with amount of HK$ 50,866,700. In the next three days, while the ratio decreased, it still remained over 30%. Therefore, combined with Blue Orca's report and the short selling performance of the market, we cannot rule out that this was a "planned" short selling operation.

But for investors, it is also a good time to buy when the stock price of a company that suffered from short selling fluctuates. If investors want to make profits after this short selling incident, they need to have a clear understanding of the intrinsic value of China Medical System.

Part 3: Investment opportunities: when undervalued companies are sold shortTo invest in a mature and innovative pharmaceutical company in the Hong Kong stock market, there are two core elements of value judgment: business with stable cash flow and reasonable arrangement of innovative drugs.

Investors need to start from these two core elements to understand the foundation of stable valuation of the company, and its development potential behind the rich pipeline of innovative drugs. These are also the core logic from which investors analyze the internal value of China Medical System.

Since IPO, the steady performance of the company has always been a highlight attracting investors.

According to Zhitongcaijing APP, China Medical System has been maintaining a high-speed revenue growth since it was listed on the main board of Hong Kong Stock Exchange in 2010. By the end of 2018, the company's turnover excluding the effects of two-invoice system reached RMB 6.135 billion, with CAGR of 28.1% in the past 10 years and the CAGR of the company's net profit reached 32.9% in the same period.

In terms of key financial indicators, the return on equity (ROE) of the company has remained above 20% since 2010; in 2018, the dividend yield of the company reached 4.9%.

In recent years, with the deepening of national pharmaceutical reform, the pharmaceutical industry has gradually entered a stage of comprehensive adjustment. The reason why China Medical System could maintain steady performance growth throughout the changing policy context was that the policy has few impacts on the company.

In the period of "two-invoice system," since "the first invoice can be directly given to a national exclusive agent of imported drugs since it can be treated as the original manufacture," China Medical System is regarded as a standard "two-invoice system enterprise," which means it is not subject to two-invoice system basically. Since 2017, the two-invoice system policy has been implemented in China, and China Medical System's performance growth tended to be stable. The company's revenue excluding the effects of two-invoice system increased by 14% and 10% in 2017 and 2018 respectively, and by 14% in the first half of 2019.

Moreover, in 2019, the supply side related policy, which "expand the scope of centralized procurement" with "price reduction", had minor impact on China Medical System in the short term. It is worth noting that the majority of nine major products, which account for more than 90% of the company's total revenue, are exclusive products, meaning they face no competition from generics. Only Plendil and Deanxit may be affected. However, currently in domestic market, none of the domestic generics for Plendil has passed the consistency evaluation while only one competing generic has passed for Deanxit. Based on the product selection rules of "there shall be three or more generic drugs to pass consistency evaluation" in the third round of centralized procurement, the impact of centralized procurement on Plendil and Deanxit will be delayed. This is undoubtedly good news for China Medical System as it is actively making arrangement of new products.

The ability to avoid risks and stabilize performance growth in the changing "deepening area" of pharmaceutical reform fully demonstrates that China Medical System has a strong capability to judge industry trends and make development plans.

While vigorously developing its existing business, China Medical System is actively making arrangement of innovative drugs and generics with sufficient market competitiveness.

As a pharmaceutical company with international development ability, China Medical System is moving towards another important path to meet huge unmet medical needs with its excellent drug searching ability and the integration of international resources to cultivate its innovative drugs pipelines. Up to now, the pipeline of China Medical System includes 19 innovative drugs in various fields including ophthalmology, dermatology, nervous system, anti-tumor, immune system, digestive system, anti-infection and endocrine system. Six of the products have been approved for launching overseas, one is under the FDA's review process, and the other five products have entered the phase III clinical trial stage. With this arrangement, China Medical System will be able to constantly launch innovative products to the market in the short, medium and long terms.

A number of innovative products that either have been launched in the Europe and the United States or prepared for marketing application are as follows:

Name / Indication / Overseas Registration / Market PotentialILUMYA(Tildrakizumab) / Moderate to severe plaque psoriasis / Approved for marketing in the U.S. / RMB5-6 billionCEQUA(Cyclosporin A Ophthalmic Solution) / Increasing tear production in patients with dry eyes / Approved for marketing in the U.S. / About RMB3 billionNRL-1(Diazepam Nasal Spray) / Patients of 6 years of age and older with acute repetitive seizures / Approved for marketing in the U.S. / Over RMB3 billionTaclantis(Paclitaxel Injection Concentrate for Suspension) / Metastatic breast cancer, locally advanced or metastatic non-small cell lung cancer and metastatic adenocarcinoma of the pancreas / NDA submitted to the FDA / Over RMB3 billion

According to Zhitongcaijing APP, the main advantages of Tildrakizumab are to provide psoriasis patients with the most cost-effective option, a novel monoclonal antibody drug specifically targeting IL-23, as well as to reduce patients' pain with less injection times. Its market potential can reach RMB5-6 billion.

The main advantages of Cyclosporin A Ophthalmic Solution are: it's the globally first cyclosporine ophthalmic eye drops, which is clear and preservative-free, and adopted Nanometer miceller formulation technology to improve in tissue. Its market potential can reach about RMB3 billion.

The important advantages of NRL-1 (Diazepam Nasal Spray) is that it's convenient to use at home as it quickly takes effect for the treatment of acute and repetitive seizures. Its potential market potential can reach over RMB3 billion.

The important advantages of Paclitaxel Suspension Injection Concentrate are: Cremophor and albuimin-free, one-step dilution and no premedication. Its market potential can reach over RMB3 billion.

Combined with the company's academic promotion ability, both revenue and profits of the company will be greatly increased after these blockbuster drugs are approved for marketing in China.

In China, there is a huge market demand for imported generics with proven quality and affordable prices. Therefore, while actively making arrangement of innovative drugs, China Medical System is also making arrangement of generics clusters with high market competitiveness.

According to Zhitongcaijing APP, China Medical System's development strategy for generics is to establish strategic cooperation with the global leading pharmaceutical companies via the light assets mode, so as to make arrangement of generic drug clusters with high market competitiveness.

In August 2019, China Medical System announced that it signed in-licensing agreements with Sun Pharma to acquire seven generic products and one highly competitive complex generic drug. In September of the same year, the company signed an in-licensing agreement with Biocon for three generics. If these drugs enter the Chinese market in the future and participate in centralized procurement, they will create a huge incremental market for the company.

As a well-known pharmaceutical company in China, enjoying a nationwide sales network guarantees the stable valuation of China Medical System.

Data shows that the number of hospitals covered by direct network of the company increased from 17,000 in 2014 to 57,000 in the first half of 2019. The network fully covered all provincial-level and the majority of prefecture-level districts, and almost covered all class III & class II hospitals as well as the major therapeutic departments of class III hospitals in China.

It is worth noting that China Medical System has adopted the academic promotion with line division mode which is similar to international pharmaceutical companies. From 2013 to 2018, selling expense ratio of China Medical System remained below 23%. After excluding the effects "two-invoice system" in 2018, the selling expense ratio was only 22.4%, even lower than the standard of selling expense ratio of international pharmaceutical companies.

These data indicated that China Medical System has strong capabilities of marketing and product commercialization, which can certainly provide strong support for its commercialization of innovative products in the future.

However, it has been undervalued by the market for a long time.

Zhitongcaijing APP observed that as of the close of trading on February 7, the share price of China Medical System was HK$ 10.2 and PE (TTM) was 10.99. Compared with the company's valuation data in the past three years, it is easy to see that the present share price of China Medical System has been far away from the median of the valuation, and obviously been undervalued. In addition, as mentioned above, the dividend yield of the company in 2018 reached as high as 4.9%, which gives another proof that the company has a high investment value based on its attractive valuation, and its reliable performance growth.

Just as a Chinese idiom "pure gold fears no fire", the turnover of China Medical System achieved the stable growth and the key financial indicators maintained reliable. In addition, the company also possessed the strong risk resisting capabilities at a time of pharmaceutical reform in China, and the strong strength and sustainable development driving force in the development of the specific business and innovation deployment. With these capabilities, the company does not fear malicious provocation by short selling agencies. At present, China Medical System stands at a status of serious undervaluation, which is a rare target with low valuation in the pharmaceutical sector of the stock market in Hong Kong. If investors can seize this opportunity, they will surely receive rich investment returns as the business performance is continually growing and the pipelines of innovative drugs are gradually launching to the market.

By Zhitongcaijing

Copyright 2020 ACN Newswire. All rights reserved. www.acnnewswire.com

Authors: ACN Newswire - Press Releases

Read more //?#