Following an almost full year of dramatic decline, the global marketing industry ended 2020 in growth

- Written by ACN Newswire - Press Releases

|

|

|

|

|

|

|

|

|

|

Following a year of disruption brought on by the global pandemic, the key takeaways highlighted in WARC's GMI review of 2020 report are:

1. Recovery is apparent across most GMI indices as businesses gain confidence in economies across the world

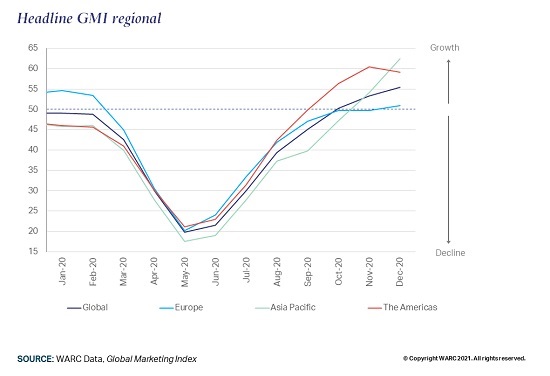

Over the last 12 months, the GMI has seen the greatest fluctuation in its history. The Headline Global Marketing Index, a summary of how the marketing industry is faring globally, reflects the volatility of 2020.

The year began in slight decline, with a dramatic drop over the first half of the year, reaching an all time low in May at 19.7 as a result of the effects of COVID-19.

Since then, as optimism for an emergence from the pandemic has grown, the index has returned to growth. The year ended with three consecutive months of increased growth rate finishing at 55.4 largely driven by markets across APAC and the Americas, with the pace of recovery slower in Europe.

2. The index for marketing budgets saw both its lifetime high and low index values in 2020

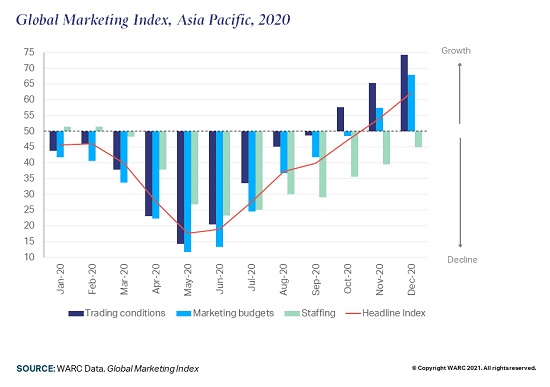

The overall index for global marketing budgets mirrored the trends of the Headline Global Marketing Index. Budgets reached an all time low of 13.4 in May, but as economies started to recover, by December, they were at a value of 57.8 with APAC showing the biggest growth rate.

WARC Data forecasts indicate that it will take at least two years for the global advertising market to fully recover.

When broken down by medium, digital and mobile are the clear drivers of growth from August onwards, driven by the boom in e-commerce as a result of global lockdowns. Digital budgets ended at an index value of 67.4 and mobile at 67.0.

TV remains a resilient channel. After returning to growth in October, it ended the year on 56.0. Although radio, OOH and press budgets have started a slow recovery, the indices for these channels have remained in decline.

3. APAC ended the year with the strongest index levels, showing increased rates of growth across most indices going into 2021

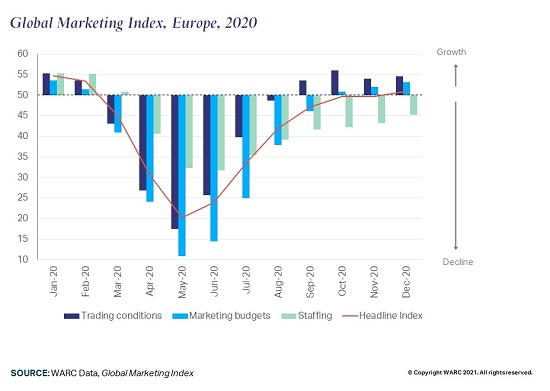

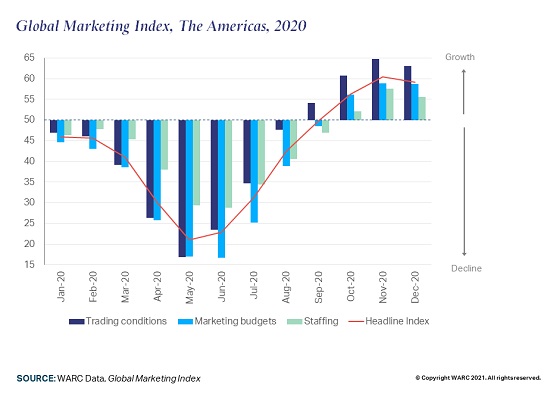

When broken down by region, the GMI indices show the varying confidence levels across the world.

APAC's increase in growth rate in the final few months of 2020 was rapid, whereas the Americas showed steadier growth over the second half of the year, with a particularly strong staffing index compared to other regions. Europe only returned to growth at the end of 2020, but is set for further challenges in 2021 as a result of Brexit and the ongoing second wave of COVID-19.

Summing up, Zoe McCready, Research Executive, WARC, says: "The Global Marketing Index trends through 2020 reflect the volatility seen over the past 12 months as advertising budgets were slashed as a result of the global pandemic. Yet the possibility of emerging from the pandemic and increasing business adaptation to the 'new normal' has seen all regions come back into growth for 2021, with APAC seeing the biggest increase in growth rate.

WARC's monthly GMI data provide a unique early look at the health of the marketing industry, and point to the ongoing strength of digital and mobile channels into 2021, driven by the continued rise of e-commerce as COVID-19 lockdowns continue in many countries."

A complimentary copy of WARC's "Global Marketing Index: A review of 2020" is available to download on lp.warc.com/GMI-report-2020.html. The GMI monthly reports are available by subscription. The next GMI report will be released on 28 January. View on www.warc.com/data/global-marketing-index for more information.

Marketers currently working for a brand owners, media owners, creative or media agencies - or any other organisation serving the marketing industry - can apply to take part in the monthly GMI panel. Find out more on www.warc.com/data/global-marketing-index/register.

Contact:Amanda Benfell Head of PR & Press +44 20 7467 8125 amanda.benfell@warc.com

Copyright 2021 ACN Newswire. All rights reserved. www.acnnewswire.com

Authors: ACN Newswire - Press Releases

Read more //?#