BDO Survey: Third-year ESG reports showed little improvement in overall disclosure and ESG practices in tackling the climate-related issues

- Written by ACN Newswire - Press Releases

|

|

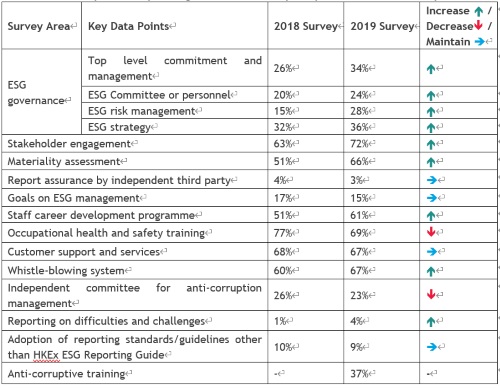

| A summary of the key findings of the 2019 Survey compared to the 2018 Survey; Summary of the Key Findings of the Survey on "The Performance of ESG Reporting of Hong Kong Listed Companies 2019" |

BDO has maintained its position at the forefront of the advocacy of excellence in ESG reporting. It has continued its dedication for three consecutive years to identify improvements, reveal weaknesses and provide further insight and professional recommendations to market players. This year, the BDO Survey on "The Performance of ESG Reporting of Hong Kong Listed Companies" (the Survey) randomly sampled 500 of the most-recent ESG reports published by both Main Board and GEM-listed companies on or before 30 June 2019. The ESG reports were evaluated based on 15 core subjects, including governance, assurance, materiality, quantitative, consistency, balance, transparency, environmental management, employment practices, occupational health and safety, development and training, supply chain management, customer support, anti-corruption and community investment.

Of the 500 companies surveyed:- 6% were constituents of the Hang Seng Index, Hang Seng China Enterprises Index and/or the Hang Seng Corporate Sustainability Index, and 94% were non-index stocks- The utilities sector led with the highest score (same as 2018), whereas the conglomerates and information technology sectors scored the lowest in terms of ESG reporting quality and performance- In light of climate-related issues, only 12% of survey companies disclosed the related policies, while 18% of these companies disclosed the details of information relevant to the actions taken in managing such issues- For mandatory disclosure on environmental key performance indicators (KPI) A, only 39% of the surveyed companies had fully disclosed as required

Limited effort in combating climate changeThe Survey reveals that only 12% of surveyed companies disclosed the related policies in identifying the climate-related issues that affected the companies and mitigating the risks of identified issues, and 18% of these companies disclosed the details of information about the actions taken in managing climate-related issues. Moreover, the Survey also reveals that companies with global operations or China-based ones have higher intentions to disclose the policy related to actions on climate change. This result indicated that some companies directly linked the existing environmental management practices as the measures to respond to climate change without a thorough risk assessment on or recognising the potential threats and opportunities that climate change brings towards actual business operations.

Limited effort in aligning goals with United National (UN) Sustainable Development Goals (SDGs) Little progress has been shown in terms of goal setting in ESG management, with a slight overall decline in the percentage of sampled companies who set goals for ESG management compared with 2018, from 17% to 15%. The Survey has discerned the trend that the larger the company, the higher percentage in goals setting on ESG management. Furthermore, only 4% of the surveyed companies have aligned their ESG goals with the UN SDGs. The top three UN SDGs selected by the surveyed companies are #3 good health and well-being, #8 decent work and economic growth and #12 responsible consumption and production.

Lack of clarification of environmental KPIs and targets The Survey also reveals that only 5% of surveyed companies disclosed the determined environmental target(s). Besides, some of the surveyed companies provided incomplete information or non-disclosure on their policies in environmental and social aspects, in particular, packaging material is the aspect with the lowest compliance level of disclosure at 38%.

Little improvement in disclosureAlthough overall ESG governance of the companies has shown improvement compared to 2018, it still falls far short of developing a well-rounded structure for ESG management. There are insufficient commitments at the director's level or oversight in ESG management, and lack of establishment of independent committee or assigned personnel in effectively managing ESG issues.

The Survey found that while 39% of surveyed companies fully disclosed the subject aspects under the "Comply or Explain" provision, the remaining companies either exhibited incomplete or non-disclosure in environmental KPIs without any explanation.

46% of the surveyed companies did not disclose any information relevant to assessment of materiality with their results in the report. The Survey also reveals that only 19% of the companies explained how they identify the reporting boundary of the ESG report.

Low level of stakeholder engagement The Survey pointed out that only approximately 23% of the sampled companies illustrated the key concerns raised from the stakeholders out of the 74% of those companies who identified the stakeholder groups relevant to their business operation for stakeholder engagement and who demonstrated clear channels of stakeholder engagement.

BDO recommendations:

Considering climate change as key ESG factor in ESG integration Given that the issue of climate change becomes the top priority affecting global humanity, listed companies have a vital role in and shall contribute to combat climate change while carrying out their business activities in a sustainable way. However, the Survey result reflected that listed companies in Hong Kong have less awareness over the impact of climate change towards their business. In this connection, we recommend listed companies in Hong Kong should embed the issue of climate change in their corporate risk assessment, in order to understand how the business models, portfolio and operation practices influence or are being influenced by climate change in detail.

Combining with the result of stakeholder engagement and materiality assessment, listed companies will be able to obtain a better picture about the priority of ESG issues and allocate more resources (eg green projects implementation) with practical ESG programmes in respond to climate adaptation, resilience and mitigation.

Setting up strategic ESG goals in line with UN SDGs Nowadays, institutional investors, asset management companies and fund managers are increasingly incorporating SDGs into their own investment frameworks because the SDGs allows them to measure the targets achievement and outcomes in a more concrete and quantitative way.

According to the survey result of Joh. Berenberg, Gossler & Co. KG, the top five most investible SDGs are: #6: clean water and sanitation, #7: affordable and clean energy, #13: climate action, #9: industry, innovation and infrastructure and #3: good health and well-being. The study also revealed that the SDGs provide a universal framework for global companies to address the ESG issues and investors are more interested in the climate change related actions and solutions from the business sectors.

Hong Kong listed companies may review and map their existing ESG metrics and strategic goals to SDGs to identify how the SDGs are related to their business directly and whether the companies can make greater contribution toward those investible SDGs for attracting global investors.

Enhancing ESG Disclosure in capturing green finance and sustainable investing opportunities With the growing trend of investors and asset managers seeking corporate non-financial information for investment analysis, ESG reporting are becoming an essential source to understand the management approaches and practices in addressing ESG risks, challenges and opportunities and ESG performance review. Companies should aim to accelerate the higher disclosure standard regardless of their company size in order to address the increasing demand from the investment community.

There are a number of effective actions for companies to take in order to enhance their ESG report to their benefits and seize the opportunity for potential new investment through ESG reporting:

- Benchmark against the peers in the industry, formulate strategy and determine a structured plan to direct the corporation's ESG policy- Engage and communicate with investors on ESG matters to understand what kind of ESG information they are actually looking for, how they use the ESG information and which ESG factors they integrate in their investment processes in order to prepare the ESG information aligning the communication dialogue that investors understand and value- Conduct comprehensive materiality assessment and communicate the details in ESG report in order to facilitate investors to better understand the rationale behind the priority of each ESG issue such that investors could adopt the reported information in their investment analyses rather than reinventing the wheel. - Adopt the widely-used international certification standards and management systems as practical tools in demonstrating the commitment to managing and improving the environmental and social performance - Seek external assurance in ESG data and reporting to enhance the credibility of the ESG report, fostering investors' confidence in company's ESG performance and reliability of information for decision-making

Apart from actions to be taken by companies, HKEx and authorities can also provide support to companies on ESG reporting to encourage improvements through various ways:

- Allocate resources to support the sophistication of ESG reporting Education and training on ESG reporting as well as emerging ESG best practices, to provide clearer guidance on materiality and reporting approach in relation to a reporting focus for specific industriesDeveloping a system (eg environmental and social KPIs database) in support of facilitating ESG performance and reporting on a regular basis

- Offer support to small- and medium-sized enterprisesDevelop a more regional perspective on ESG reporting and gradually link up with the global standard Allocate resources to support the initiatives for Hong Kong enterprises to take part in green projects and to take advantage of quality ESG disclosure

External advisory or consultancy services could be utilised to provide an independent assessment of ESG performance and drive continuous improvement in areas. Authorities could also provide complementary professional services to less-prepared companies seeking advice on ESG performance as alternatives to assurance services for companies that have progressed in ESG performance.

Clement Chan, Managing Director of Assurance of BDO, suggested, "To seize the opportunities from green financing as well as to uphold Hong Kong's reputation as an international financial hub, we see companies should pave the way for better business and investment opportunities by enhancing their ESG reports through following more global reporting practices. Listed companies are recommended to enhance the disclosure of ESG information to meet stakeholders' information and investment needs. This can be achieved by providing detailed information on management's involvement in ESG strategic goals setting, materiality assessment, assessing the impact of climate change on business operations and their associated risks and opportunities, selection of SDGs and their rationale behind, developed measures in combating climate change and related performance, etc. Besides, we suggest that government and HKEx offer greater support and incentives to companies to enhance their ESG reports to meet global standards".

Johnson Kong, Managing Director of Non Assurance of BDO, remarked, "Nowadays, green finance is an important topic among the investment community. At the initial stage of developing green finance and climate investment in Hong Kong, companies' initiative and engagement in these aspects remain low with only 2% of the sampled companies have issued green investment products such as green bonds and green loans. Furthermore, only limited number of companies have reported climate related issue with restricted information disclosed. We hope to see higher engagement from companies on ESG reporting and climate investment as they gain increasing awareness of the importance of ESG. Thus, to facilitates the development of climate investment and transforms the world economies into a sustainable model".

Ricky Cheng, Director and Head of Risk Advisory of BDO, said, "Nowadays, we see investors are not merely looking for monetary returns but also on how well a firm meets its ESG objectives and creates corresponding, measurable value. It is disappointing to see that the third year of mandatory ESG reporting performance has shown less improvement, with weak and indistinct disclosure of information. While large companies have more resources and outperform the small and medium enterprises, a large numbers of companies tend to fulfil the minimum requirements under the HKEx ESG Reporting Guideline and underestimate the true values that ESG management and reporting can bring along to the companies. Various studies revealed that more institutional investors, asset management companies and fund managers have integrated ESG component as part of their investment strategies, with an aim to enhance sustainable investment returns and mitigate risks. Companies continue to adopt box-ticking approach and meet the requirements of HKEx ESG Reporting Guide as minimum no longer fit the purpose and undermine the capability of the companies to attract investment. We hope our suggestions can provide more specific guidelines and directions for companies to improve their ESG reporting, with the ultimate aim to boost their investment value and inspire investor confidence".

About BDO BDO's global organisation extends across 162 countries and territories, with more than 80,000 professionals working out of over 1,500 offices - and they're all working towards one goal: to provide our clients with exceptional service. BDO was established in Hong Kong in 1981 and is committed to facilitating the growth of businesses by advising the people behind them. BDO in Hong Kong provides an extensive range of professional services including assurance services, business services and outsourcing, risk advisory services, specialist advisory services and tax services. For more details, visit www.bdo.com.hk.

ContactsBDO in Hong Kong Sala LoSenior Marketing Manager, BDO Hong KongTel +852 2218 3042Mobile +852 9613 5175salalo@bdo.com.hk

Dora ShingAssistant Marketing Manager, BDOHong KongTel +852 2218 3110Mobile +852 9016 8063dorashing@bdo.com.hk

Strategic Financial Relations LimitedVicky LeeTel +852 2864 4834vicky.lee@sprg.com.hk

Adrianna LauTel +852 2114 4987adrianna.lau@sprg.com.hk

Copyright 2019 ACN Newswire. All rights reserved. www.acnnewswire.com

Authors: ACN Newswire - Press Releases

Read more //?#